Having a cosigner is not uncommon in the current financial climate. Parents and older family members might find themselves aiding their millennial counterparts in getting financing for vehicles, housing, and, more commonly, education—a 2012 report by the Consumer Financial Protection Bureau and the Department of Education found that over 90% of private student loans were cosigned by parents.

Helping someone to get a loan approved can be a rewarding experience both for personal and financial fulfillment, but cosigning is not without its risks.

In this post, we’ll discuss what cosigned loans are, as well as the pros and cons of having them in certain scenarios. We’ll focus more on cosigned loans from financial lenders (like banks or credit unions) rather than personal loans (from friends or family) because cosigning personal loans is a less common practice.

What Does Cosigning a Loan Mean?

In a standard Loan Agreement, one person (a borrower) receives money from another person or financial entity like a bank (a lender) and promises to pay the money back within a specific time frame. In a cosigned loan, the borrower has a second person (sometimes a third, but not commonly) sign the loan as a cosigner.

The cosigner is equally responsible for the loan even if they’re not the one responsible for making payments. They are essentially insurance for the lender in that they are promising to repay the loan if the primary borrower stops making payments.

In the case of personal loans, like between friends or family members, some lenders might require a cosigner because they don’t believe that the borrower will be able to pay them back. In such cases, the lender can sue the cosigner in small claims court to have the debt repaid, but it’s not a very common practice.

Requiring a cosigner is typically used by financial entities when an applicant’s creditworthiness doesn’t meet the institution’s standard.

How Does a Cosigned Loan Affect My Credit Score?

Cosigning a loan can affect the credit rating the borrower and the cosigner, and whether or not the impact is positive or negative depends on a few factors.

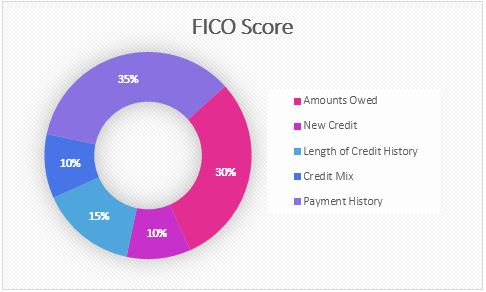

Many banks and creditors in the United States use a FICO score to measure a potential borrower’s creditworthiness. It measures the risk of default (not being able to pay off the loan) by looking at several variables in a person’s financial history and calculating their value based on the FICO model.

Taking on a new loan adds to each of the percentiles above and affects the overall rating.

For the primary borrower, having a cosigner can help you improve your credit, especially if you don’t have much credit history or if you have bad credit. Creditors might be wary of lending you money for a different loan with a brand new cosigned loan on your record because you might not look financially responsible (yet). For example, if you’ve just had a cosigner for a car loan, you’ll likely need a cosigner if you want to get a boat loan right away.

But with a little time and many on-time payments, your credit score can increase, and in doing so, you can raise your reputation with creditors.

For the cosigner, a new loan, whether you are the primary borrower or not, will add to the “Amounts Owed” percentage listed on the chart above. This section comprises how much you’re borrowing, how many accounts you have owing, and how much money you still have to pay back. This is also known as a debt-to-income ratio; creditors will look at how much money you make per month and how much of that income goes towards paying existing debts.

Adding more debt to this area can bring your credit rating down. However, if you, as the cosigner, have a long credit history with a great payment record, the effect of the new loan should be minimal.

For both parties, having a successful loan under your belt can only help your credit. So long as payments are made on time and in full, nothing should go wrong with your rating.

Why Should I Cosign a Loan?

Cosigning can help the primary borrower applying for the loan to obtain the money they need, which they might not have been able to do on their own. Having you vouch for a person with little or no credit increases their chances of getting financing.

You can even vouch for someone who’s already been denied before. Creditors will often reconsider an application if the applicant returns with a viable cosigner.

Cosigning can also help an applicant build or improve their current credit rating, so maybe next time they apply for a loan, they won’t need a cosigner at all.

These are some of the most common scenarios for cosigning:

- Sometimes parents cosign loans for their children because most young adults don’t have a long enough borrowing history to get approved for a loan on their own.

- Spouses cosign loans together either because one has a better rating than the other or because they’ll both be making payments together, for example, if they’re financing a new car or starting a mortgage. Having two separate incomes also helps the debt-to-income ratio because you’ll have two incomes and only one debt, likely boosting your rating and making approval easier.

- People who don’t plan to finance anything in the future. For instance, a retired uncle with his car and house paid off cosigns a student loan for his niece. This works well because the uncle might have trouble applying for a new loan (like for a new car or remortgaging his house) right away with a fresh cosigned loan on his record.

Why Shouldn’t I Cosign a Loan?

There are a few cons to cosigning that you should consider before signing on the dotted line:

- If the borrower defaults on the loan, you are completely liable for paying off the remaining balance, and your credit will drop as though you were the one who defaulted.

- If the lender sues for payments not being made, they tend to sue the cosigner first because their credit rating is higher (so they’re more likely able to pay off the debt).

- You cannot take your name off the loan after you’ve cosigned. Until the debt is settled, you’re on the hook.

- You (or, rather, the other borrower) can destroy your credit rating if payments are late or the loan defaults.

- It can put a heavy strain on the personal relationship you have with the other borrower, especially if they’re not keeping up with payments.

Consider Your Specific Situation

Cosigning a loan for someone boils down to personal choice. If you’re approached by a friend or a family member to help them get approved, you need to take stock of your finances and your credit before you make the decision.

Evaluate the risks and benefits before you commit to a long-term debt, just as you would for yourself because, at least on paper, this is your debt as much as the other person’s. Figure out if your credit can handle it, and if it can’t, it might be a good idea to politely decline.

Have you cosigned a loan before?